January 26, 2023

An In-depth Look at How Crypto Transactions Work

The Important Bits

Crypto transactions are processed differently than traditional fiat currency transactions. Instead of being transferred between accounts, crypto transactions involve shifting data around on the blockchain. The blockchain acts as a public ledger and records every transaction, ensuring that funds belong to a specific blockchain address. The process of crypto transactions is broken down into three stages: creating, broadcasting, and confirmation. In order to initiate a crypto transaction, users need to create and sign a transaction using a crypto wallet. Then their wallet broadcasts the transaction information to the blockchain network for validation. After it is validated by the network of computers on the blockchain, it is then confirmed by miners/stakers and added as a permanent piece of the blockchain.

In this article

Crypto transactions vs fiat transactions

Although both crypto and fiat currency can be used as a means of exchange for goods and services, the way those transactions actually work at the nuts and bolts level is really quite different.

When you write a check or initiate a bank transfer through a traditional financial institution, the funds are moved from one account to another. Crypto, on the other hand, doesn’t sit in a bank like the fiat currency in your checking account. Instead, crypto “lives” on the blockchain. The blockchain acts as a public ledger of every transaction ever made. Any transactions made in cryptocurrency are simply shifting data around between blockchain addresses. This means crypto funds never physically change hands the way fiat does. Rather, transactions are permanently recorded on the blockchain designating which funds belong to which address.

The entire process of how crypto transactions are processed can be broken down into three distinct stages: creating, broadcasting and confirmation. If you’ve ever wondered how crypto transactions work, read on for an in-depth guide designed to break the process down in easy to understand terms.

Step 1: Creating a crypto transaction

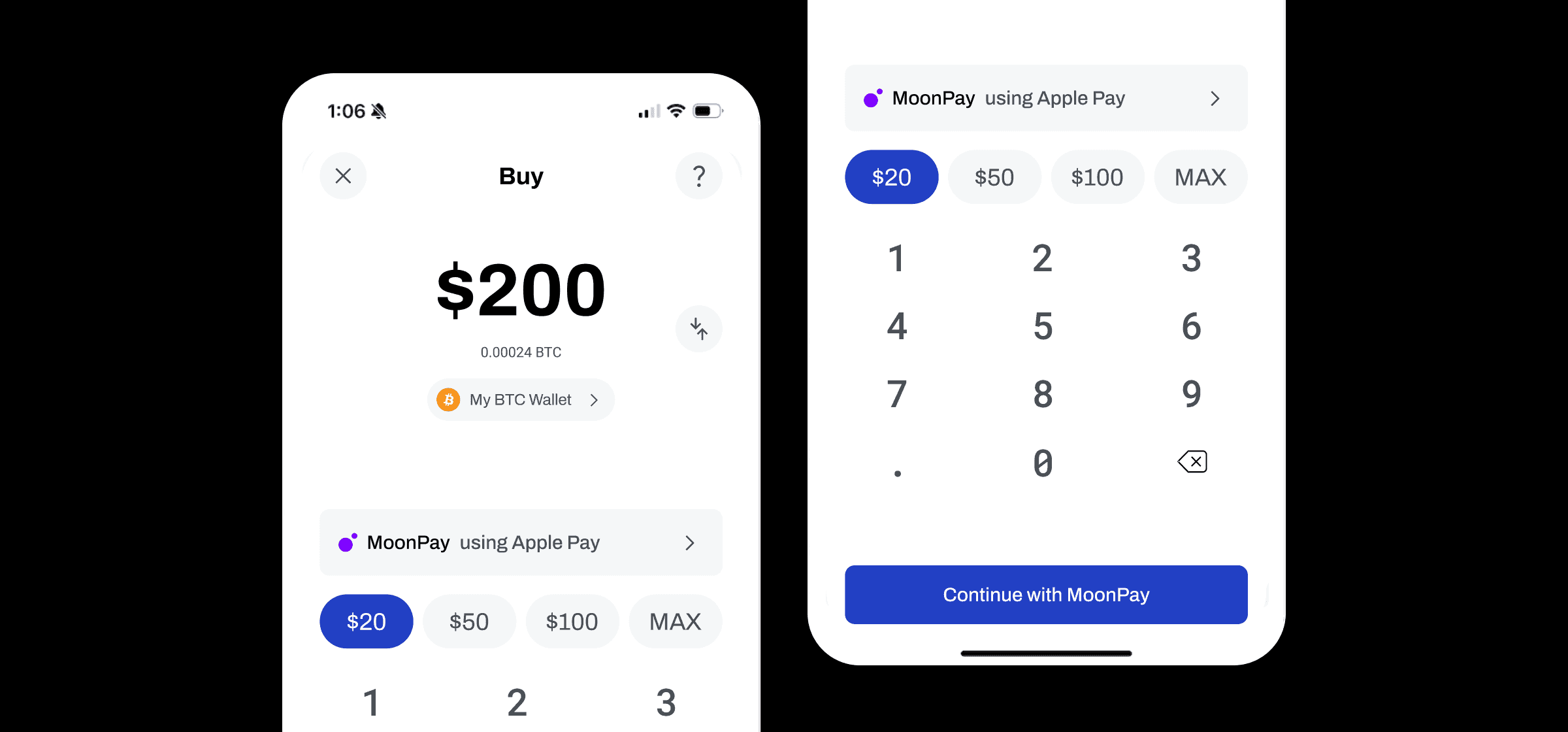

The first step in the crypto transaction process is creating and signing a transaction. This step happens within a crypto wallet application and is the most visible to end users.

Every cryptocurrency transaction requires several distinct pieces of information:

The senders address - the unique address linked to the the senders wallet

Cryptocurrency amount - the amount of crypto being sent to the receiving wallet

The destination wallet address - the unique address linked to the receiving wallet

In order to initiate a crypto transaction, you’ll first need the recipient's wallet address to know where to send the funds. The wallet address is an alphanumeric text function similar to that of an email address or bank account number. Most wallet applications will likely present this data in the form of a string of characters or scannable QR code.

Once the sender specifies the recipient's address and the amount of crypto and hits “send”, their wallet application creates a message that bundles all of this information together. Using the wallet’s private and public keys, it creates a digital signature that will be used to confirm their identity. The wallet sends this information to a network of computers on the blockchain where it will be checked for accuracy in a process known as broadcasting.

Every crypto wallet comes with a pair of cryptographically linked keys, one public and one private. The public key is like an email address or checking account number – it can be safely shared with anybody looking to send you crypto. Private keys, on the other hand, must be kept safe at all times, as whoever possesses your private keys can control all of the funds in your crypto wallet.

Step 2: Broadcasting crypto transactions

Before any proposed crypto transaction can be completed, it must be broadcast to its respective network for validation. Once you hit “send” to initiate a transaction, the wallet sends the transaction details to the blockchain network. Individual computers that make up the cryptocurrency network, called nodes, are then tasked with verifying the details of the transaction. Nodes will check digital signatures to prevent fraud and review the wallet’s balance to confirm that you have the funds necessary to complete the transaction.

After blockchain nodes have verified that you own your funds and you have enough to complete the transaction, your transaction is held in a mempool (short for memory pool). The mempool is a sort of waiting room where verified but unconfirmed transactions are held while they await confirmation. Since validators are rewarded for adding new transactions to the blockchain, low fee transactions may sit in the mempool stage for longer than those with a higher fee.

As transactions make their way from the broadcasting stage through the confirmation stage, you are able to use a tool called a block explorer to view a transaction status. Block explorer tools are free and open to anyone to see the status of pending transactions, as well as previously confirmed transactions. For example, an “unconfirmed” transaction is one that has been broadcast and validated by nodes, but not confirmed and added to the blockchain. Your wallet app will also likely show the status of your transaction.

Step 3: Confirming a transaction on the blockchain

In order for a transaction to be added to the blockchain, it must go through the process of confirmation. Since cryptocurrency networks by design operate without a central intermediary, there needs to be some sort of governing mechanism in place that keeps the system secure. Before a transaction can be recorded on the blockchain, it must be pulled from the mempool and validated by multiple network participants through what is known as a consensus algorithm. The two most popular consensus algorithm types are proof-of-work (PoW) and proof-of-stake (PoS).

Bitcoin (BTC) is the quintessential example of a cryptocurrency that uses proof-of-work. On proof-of-work blockchains, miners verify transactions using high-powered computers, competing to be the first to solve enormously complex mathematical equations. The miner who successfully cracks the code is then permitted to propose a new “block” which is then added to the “chain” of previously confirmed blocks of transactions. Hence the name, “blockchain”. Miners are rewarded in a set amount of crypto for their efforts. As of May 2020, that amount is 6.25 BTC per block, though mining rewards are reduced by half every 4 years (an event known as the “Halvening”).

Blockchains using proof-of-stake consensus algorithms don’t depend on resource-intensive computing power to validate transactions. Instead, network validators put up or “stake” a certain amount of the network’s native crypto, which is locked up in a smart contract on the blockchain. Validators are randomly selected to verify new transaction blocks. The funds are released only when a proposed transaction block is recorded, which disincentivizes dishonest participants from erroneously recording invalid transactions. Most blockchains utilizing proof-of-stake incentivize network validators with staking rewards, akin to earning interest on a bank deposit. Some well-known proof-of-stake cryptocurrencies include Solana (SOL), Cardano (ADA) and Polygon (MATIC). In September of 2022, Ethereum (ETH), the second largest cryptocurrency by market cap, transitioned its network from proof-of-work to proof-of-stake consensus in an event known as “The Merge” in crypto circles.

Anytime your transaction is confirmed, you’ll pay a fee that goes to the miner/stakers which are validating the transaction. Fees will vary based on multiple factors like the transaction size and network congestion. The good news is there are ways to pay less in fees. Read our guide to crypto fees and how to pay less of them to learn more.

Receiving funds

Once a transaction has been sent, broadcast and confirmed, your funds will be available in your wallet. You may use your wallet or a blockchain explorer to verify that your transaction has changed from “unconfirmed” to “confirmed”. The process of making a crypto transaction is now complete.

What’s next?

Once a transaction is complete, you’re free to use your shiny new crypto any way you please. The BitPay Wallet offers a huge range of options for storing and spending your crypto.

Secure storage

If you adhere to the HODLer philosophy, you can securely store your funds in BitPay’s self-custody wallet under the protection of multi-sig and optional key encryption. All while being able to seamlessly manage your assets across platforms.

Send via P2P transactions

Want to send crypto to a friend? Piece of cake. Simply enter the recipient’s wallet address or scan their QR code with the BitPay app, hit send (after double- and triple-checking the address) and voila, your payment is on its way.

Spend with BitPay merchants

BitPay partners with thousands of companies and stores across dozens of categories to enable direct crypto payments from any wallet. Scan through our Merchant Directory for a comprehensive and ever-growing list of crypto-friendly retailers where you can spend crypto, including both online and in-person options.

Load up a crypto debit card

If you’re a serious crypto consumer looking for as many ways to spend cryptocurrency as possible, a crypto debit card like the BitPay Card offers an elegant and flexible solution. Simply apply (it takes only minutes, we promise), then once approved, connect your wallet and load up the card with your favorite crypto. Then you’re ready to spend it as dollars anywhere in the world Mastercard is accepted. You can even earn cash back rewards on purchases when you download the BitPay app.

Buy gift cards

Another great way to spend Bitcoin or more than a dozen other top cryptocurrencies is buying gift cards. BitPay makes it easy to buy gift cards with crypto for hundreds of top brands including Best Buy, The Home Depot, Google Play and many, many more.

Swap for other cryptos

Want to exchange one crypto for another? Swap tokens in the BitPay Wallet, which has partnered with Changelly to allow low-fee crypto swaps for more than 50 coins across the most popular blockchains.

Explore dApps and DeFi

Even if you’ve already gotten your feet wet in the wide world of crypto, you may just be scratching the surface. Crypto is made up of a vast universe of fascinating communities, projects and applications. Participating in these further-flung corners of the ecosystem sometimes requires picking up a small amount of a network’s native cryptocurrency. Once you’ve done this however you’re free to explore a range of new and exciting opportunities, from passive income and lending opportunities in decentralized finance (DeFi) to blockchain-verified ownership and digital art through nonfungible tokens (NFTs).

Want to use the best wallet for making crypto transactions?

Note: All information herein is for educational purposes only, and shouldn't be interpreted as legal, tax, financial, investment or other advice. BitPay does not guarantee the accuracy, completeness, or usefulness of any information in this publication and we neither endorse, nor are we responsible for, the accuracy or reliability of any information submitted or published by third parties. Nothing contained herein shall constitute a solicitation, recommendation, endorsement or offer to invest, buy, or sell any coins, tokens or other crypto assets. BitPay is not liable for any errors, omissions or inaccuracies. For legal, tax, investment or financial guidance, a professional should be consulted.