November 11, 2022

What is a Crypto Swap and How Do I Start Swapping?

The Important Bits

Crypto swaps let you exchange one cryptocurrency for another without converting to fiat. These swaps can be done within wallets like BitPay or through decentralized exchanges, offering speed, convenience, and better portfolio management. They’re ideal for diversifying holdings or reacting to market trends quickly.

The top 10 cryptocurrencies make up a sizable majority of the total crypto market cap, but there are actually thousands of smaller tokens and projects out there that compose the rest. Sometimes, for various purposes we’ll get into momentarily, you’ll want to switch one cryptocurrency for another. This once required selling one token for fiat, then purchasing the second with the fiat. It was an expensive and inefficient method to jump between coins, but it was the norm until the innovation of token swaps.

Ahead we’ll dive into how to swap cryptocurrency, including some key features and benefits.

In this article

What is crypto swapping?

Crypto swapping allows you to instantly trade one cryptocurrency for another, with no crypto-to-fiat exchange required. Saving time and paying less in fees are obvious benefits, but it’s far from the only reason users participate in swapping.

Crypto tokens are effectively the keys to their native blockchain’s kingdom, affording holders various benefits within their ecosystems. Token holders may have the opportunity to vote on community governance proposals that guide the future of a project or stake their share in exchange for passive interest income. Swapping makes it easier for crypto users to explore the further reaches of the blockchain, and be a part of multiple projects they wish to support.

Sometimes swaps are necessary to cover the fees on a transaction that can only be paid in a specific blockchain’s native coin. Other times, traders will perform a token swap in the hopes of capitalizing on a move in the market they sense is coming. Participating in certain protocols, such as decentralized finance (DeFi), can only be done via specific blockchains. This means if you’re a Bitcoin user, you may need to swap for some Ethereum or another ERC-20-compatible token if you want access to the DeFi ecosystem.

Crypto swap vs exchange/trade

It’s true that the words “swap” and “trade” can be taken as synonyms, but in crypto parlance they have quite different meanings. Although the end result is essentially the same (start with one coin, end with another), their respective processes vary greatly.

Trading requires exchanging one cryptocurrency for fiat and then purchasing another coin with the fiat you obtained. If taking place on a crypto exchange, you’ll be hit with whatever commission or other fees they charge on both sides of the transaction.

Swapping, on the other hand, allows users to seamlessly transfer one cryptocurrency for an equal amount in value of another. Transactions happen instantaneously, and without the need to first exchange crypto for fiat. Crypto exchanges offer up various “trading pairs”, asset combinations that can be swapped within their platform. Different swap services offer different trading pairs, and those allowing swaps between two very small or obscure coins may be more difficult to find.

How do I swap crypto?

Swapping is a popular activity among crypto users, so services of various types and sizes now offer swaps. There are three primary venues where crypto swapping takes place:

Within a wallet (like the BitPay Wallet)

Decentralized exchanges

Centralized exchanges

Swapping within the BitPay Wallet

Swapping directly from the BitPay Wallet is an easy way to maintain full control over your crypto conveniently in one place. The BitPay Wallet is a non-custodial wallet (aka self-custody), meaning that there is no third party holding your crypto. You have full control over your assets, BitPay just assists in making the transactions. BitPay partners with Changelly to facilitate low-fee swaps for over 50 coins across the most popular blockchains.

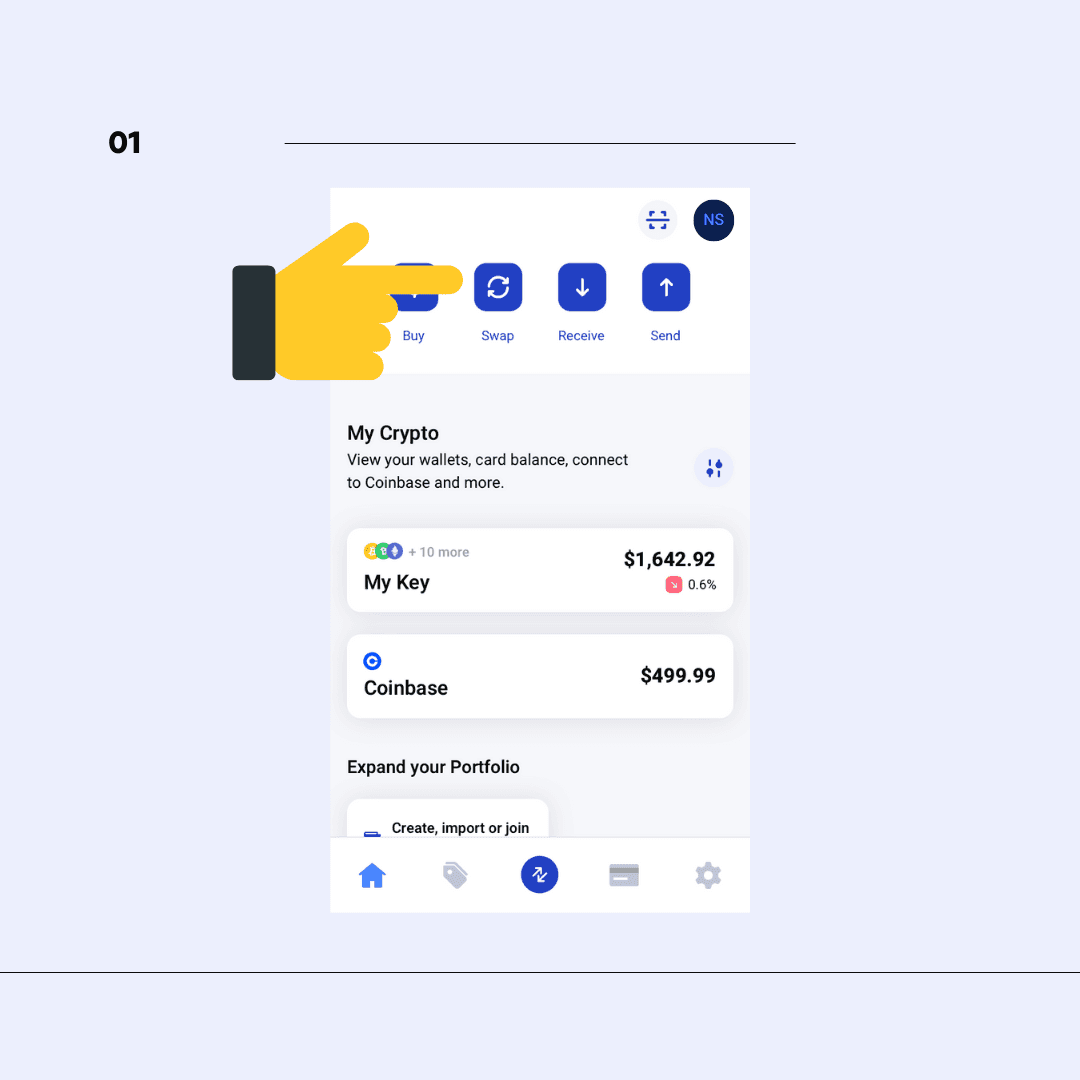

Step 1: Tap Swap

Open your BitPay Wallet and tap the Swap option on the home screen.

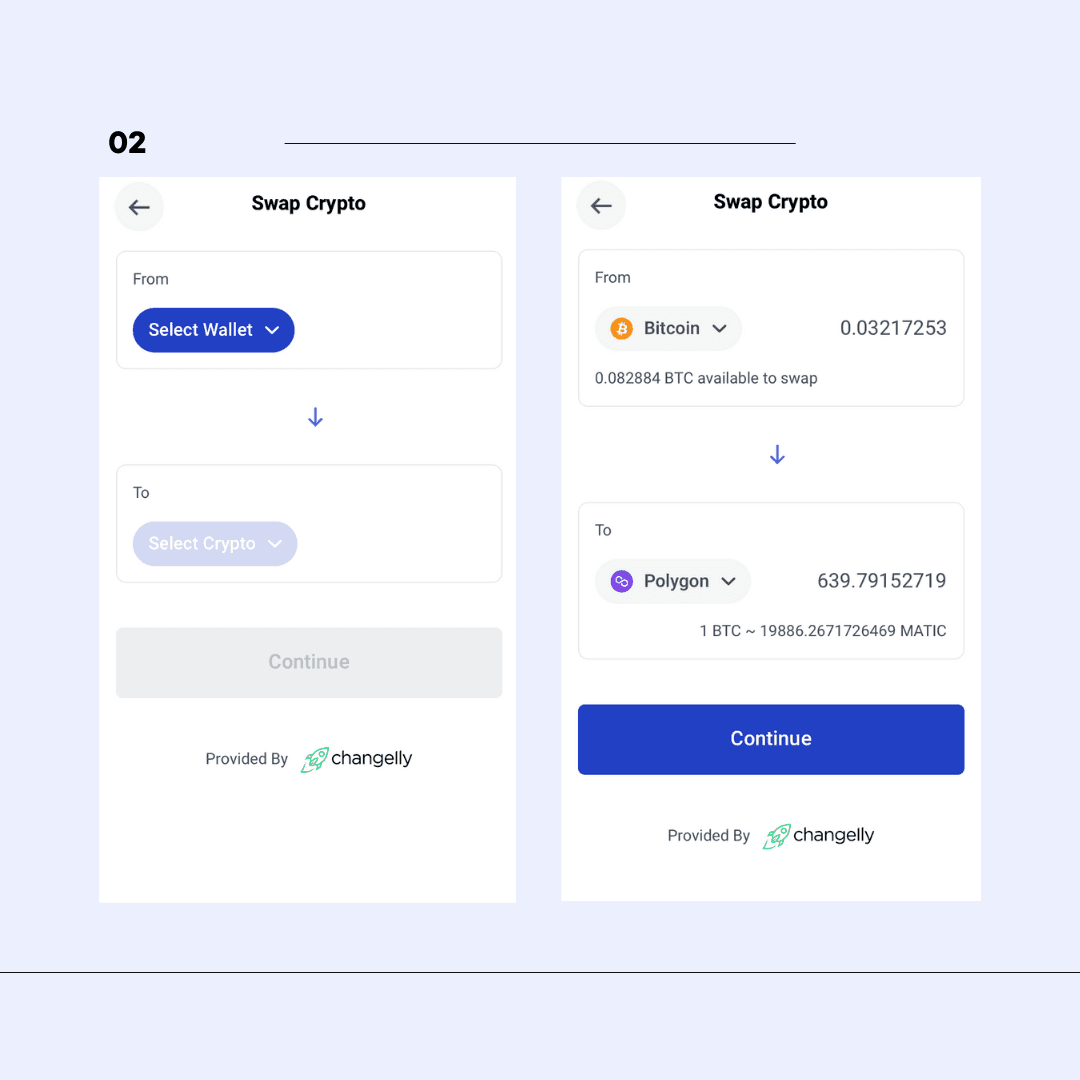

Step 2: Choose your swap pair

Select the crypto you want to swap (From) and the token you’d like to receive (Swap to). Then enter the amount of crypto you want to swap (either in fiat or sats/gwei).

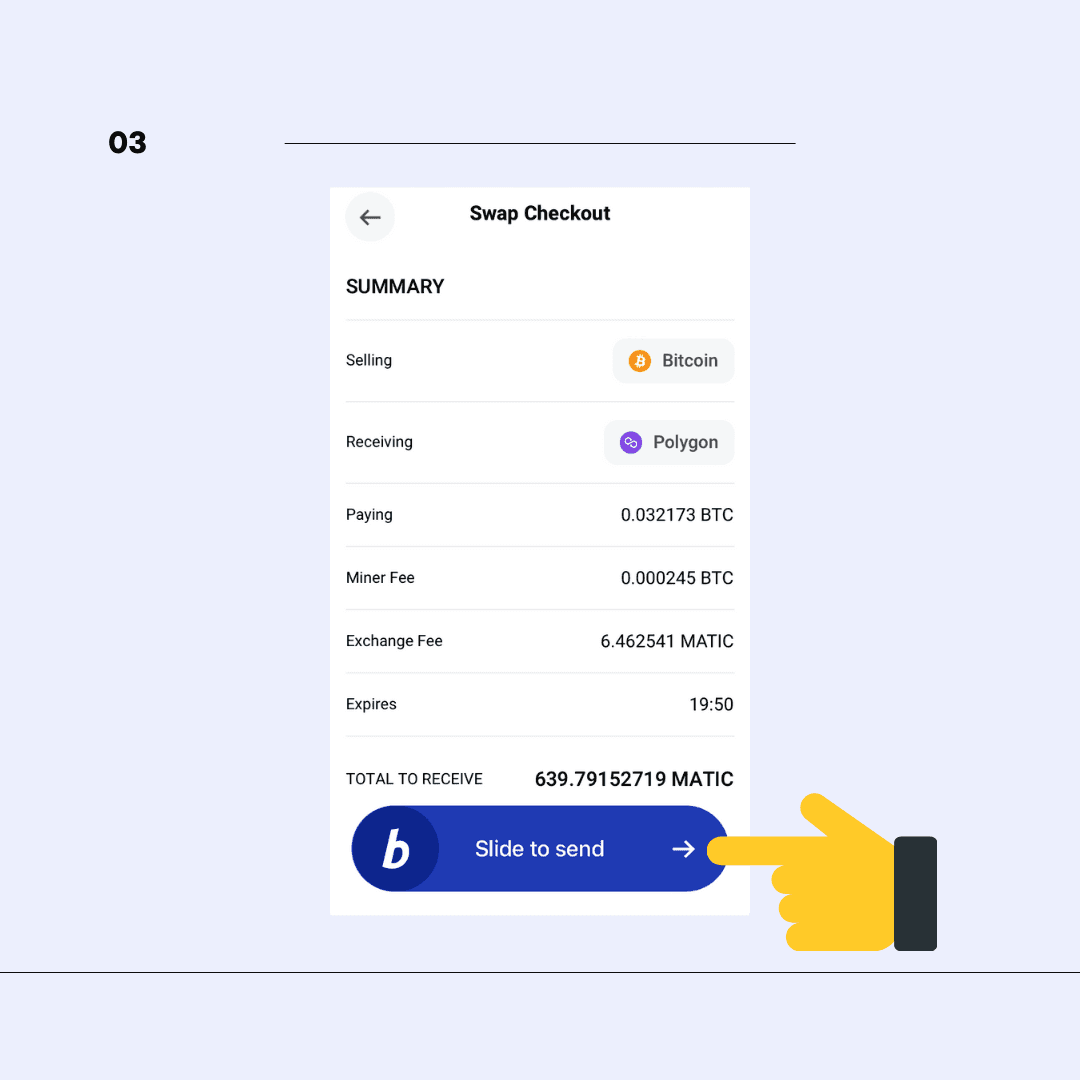

Step 3: Review swap details and confirm

You’ll see a swap details page with the swap summary including outgoing funds, associate fees and the total amount of crypto you’ll receive. This offer will expire, so make sure to confirm the swap in a timely manner. Accept Changelly terms and slide to confirm the swap.

Start swapping in the BitPay Wallet

Swap on a DEX (Decentralized Exchange)

A decentralized exchange (DEX) involves no central governing authority, and instead is regulated using self-executing smart contracts. DEXes are peer-to-peer, meaning they allow users to directly exchange cryptocurrency without a middleman. You can usually tell if a service is a DEX because their names often contain the word “swap”. Some popular options include Uniswap, PancakeSwap and SushiSwap.

Swap on a CEX (Centralized Exchange)

Centralized exchanges, such as Coinbase or Kraken, are platforms owned or operated by a central organization that facilitates transactions between users. Many CEXes offer crypto swapping services, chiefly differentiating their offerings through the variety of available trading pairs as well as their transaction fees. Because most users start their crypto journeys with a centralized exchange, they are designed to be user-friendly. As an arm of the custody service, your crypto received in the swap will remain under control of the exchange.

What is an atomic swap?

Much like how you’d never put diesel gasoline in a conventional engine, attempts to send crypto to an incompatible blockchain can result in disaster, including lost funds. For example, you can’t send Bitcoin to an Ethereum address, and vice versa. To safely execute a trade across blockchains requires an atomic swap, a peer-to-peer method of exchanging cryptocurrencies between two different blockchains without the need for any third-party involvement.

Atomic swaps include built-in functions requiring both participants to fulfill certain predetermined steps before a transaction can be finalized. Atomic swaps utilize something called Hashed Timelock Contracts (HTLC) which impose certain trading conditions and a time constraint mandating they also must be completed within a set time.

A simplified version of how this works is as follows. Alice and Bob have agreed to exchange her 25 ETH for his 1.5 BTC. First, Bob must create a smart contract address to which he sends his BTC. The contract will auto-generate a unique cryptographic key that’s needed to access the funds. Based on this key, the smart contract also generates an encrypted (or “hashed”) version of the key, which Bob then sends to Alice.

Using this hashed key, Alice can verify that Bob has indeed deposited his funds. However there’s no possible way for her to withdraw the funds until the conditions of the swap have all been met. Alice must then generate her own contract address based on the hashed key where she can send her ETH. Once Bob claims the funds Alice has locked up in the smart contract, the password Alice needs to access Bob’s deposit is automatically revealed.

Is swapping crypto taxable?

The dreaded “taxable event” is the scourge of any honest crypto trader. It’s well known that any crypto-to-fiat exchange is considered taxable in the eyes of the Internal Revenue Service (IRS). But what many people don’t know is that even crypto swaps are seen as taxable events, and therefore are subject to capital gains tax.

Which cryptos can I swap?

Between the options outlined above, you can exchange virtually any cryptocurrency for any other, though some swaps may be harder to find. If utilizing a centralized exchange (CEX), your options will be limited by the trading pairs the company decides to offer. Through a decentralized exchange (DEX), peer-to-peer swaps of any two cryptos can take place as long as there’s a willing party on both sides of the transaction.

Note: All information herein is for educational purposes only, and shouldn't be interpreted as legal, tax, financial, investment or other advice. BitPay does not guarantee the accuracy, completeness, or usefulness of any information in this publication and we neither endorse, nor are we responsible for, the accuracy or reliability of any information submitted or published by third parties. Nothing contained herein shall constitute a solicitation, recommendation, endorsement or offer to invest, buy, or sell any coins, tokens or other crypto assets. BitPay is not liable for any errors, omissions or inaccuracies. For legal, tax, investment or financial guidance, a professional should be consulted.