November 2, 2022

Crypto Winter 2022: Survival Tips to Get You Through the Freeze

The Important Bits

Are we in a crypto winter? If you feel that nip in the air, you’re not alone. It’s the icy chill of another crypto winter. Trillions of dollars in value have been knocked off the cryptocurrency market cap since the start of 2022. It’s tough out there, but this isn’t the time to panic. The global crypto market has been through this before and likely will again. So bundle up and throw another log on the fire as we talk about some strategies to help you get through to the thaw.

In this article

What is crypto winter?

Similar to a bear market in traditional securities, a crypto winter is when digital asset prices drop and remain substantially lower than their most recent highs for a prolonged period. Technically speaking, bear markets require a 20% peak-to-trough price retreat, but crypto winters have no such specific metric. But you don’t need a thermometer to know we’re currently well into crypto winter territory, with Bitcoin down more than 70% off its all-time high as of October 2022.

As a nascent asset class, there really isn’t a super-lengthy historical record to examine for help predicting when this particular crypto winter will end. But thanks to the magic of hindsight, we can certainly pinpoint where it began.

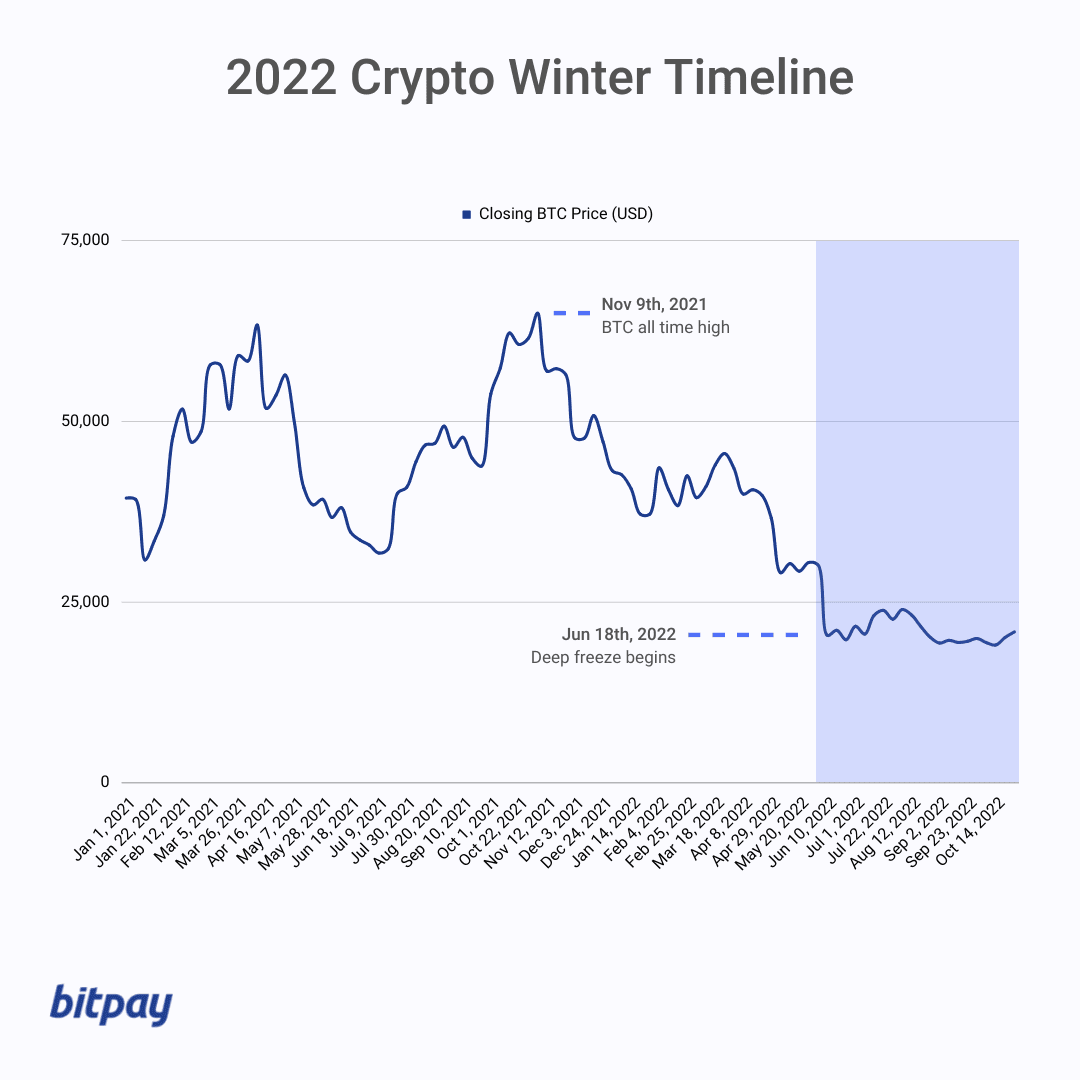

When did the crypto winter start?

Crypto prices can be volatile, so bona fide crypto winters are tough to distinguish until they’re well under way. We can surely say that the latest crypto winter started sometime between late 2021 and the middle of 2022. Looking at total market cap data, the absolute peak of the 2021 bull run fell right around Nov. 9, when the value of the total cryptocurrency market cap was a hair above $2.9 trillion. As of late October 2022, that number has sunk to $918 billion, a nearly 70% skid.

After last year’s “everything rally” when it was tough to lose money on virtually any investment, a short-lived crypto market correction to kick off 2022 was probably to be expected. Corrections are, after all, part of a normal, healthy market cycle. But when prices sank and remained depressed well into spring, and collapsed even more by the start of the summer, most observers agreed we were indeed in the throes of another crypto winter.

A look at how the crypto winter has played out so far

This crypto winter’s hair-raising price decline didn’t happen overnight. It started with two steep drops, one between Nov. 10 of last year and Jan. 24, during which prices fell around 25%. The intensity of the decline leveled off slightly through early spring, with the market even gaining back some lost ground. But then in April the slide continued apace, culminating with a precipitous weeklong bloodbath in mid-May in which another $300 billion was erased from the crypto market. Over the summer the total market cap slid to around $900 billion which is around where it remains to the day of this writing, signaling a deep freeze yet to be broken.

Cryptocurrency isn’t the only digital asset experiencing a nosedive this year. Nonfungible tokens (NFTs) were plucked out of semi-obscurity to become a mainstream phenomenon in 2021, but this year has been a very different story. NFT sales dipped 60% between Q2 and Q3, and are now down 73% from their peak in Q1.

The last major crypto winter started in 2018, which, just like this year’s version, quickly followed a dramatic run-up in prices. For years leading up to the last crypto winter, the cryptocurrency market cap hovered somewhere between $5 and $15 billion. Then at the start of 2017, we were moon-bound. The price of Bitcoin went from just over $1,000 in January 2017 to over $17,700 by the end of the year. Then the tide turned, and the market plunged nearly 60% by February; the first major crypto winter was upon us.

A few modest run-ups aside, the last crypto winter endured until the start of 2021, when we once again found ourselves bound for the moon. Less than 12 months later, most of us have had a rough landing back to earth.

Crypto markets are highly cyclical, and it can be difficult to pin down a catalyzing event directly responsible for a large up or down price swing. One notable exception being Bitcoin “halving”, a process that reduces the rewards issued to miners per block of completed transactions, which has historically put upward pressure on the price of Bitcoin.

Halving occurs at set intervals, namely every 210,000 blocks, and cuts the reward by 50% each time. Back in 2009, the reward for mining each new block was 50 BTC. By 2012 it had dropped to 25, then 12.5 in 2016. In 2020 another halving saw the reward slashed again to 6.25 BTC, and the next, which is estimated to occur sometime in 2024, will reduce it to 3.125 BTC. Bitcoin’s block reward is set to continue halving in this manner until the coin’s entire 21 million supply has been mined.

Tips for surviving the crypto winter

Whether we’re talking stocks or crypto, investing can be a rollercoaster ride. You probably knew that when you bought your ticket, but it’s a good reminder all the same. This year has been challenging for investors across nearly every asset class, so it can be hard shaking off the exuberance hangover from a year like 2021, where assets more or less only went up. Here are a few more things to keep in mind when the frigid chill of crypto winter gets you down.

Don’t panic, we’ve been through this before

As we pointed out, the crypto market has gone from rock-bottom lows to sky-highs and back again before. And in the intervening years, new technologies and ecosystems have continued to flourish in the space, a good sign for its continued survival.

Buy the dip if you can afford it

One certainty of the crypto winter is low prices. If you spend any time in crypto circles you’ve no doubt heard the “buy the dip!” rallying cry used among enthusiasts to encourage more buying when assets are “on sale” as during a crypto winter. Whether you do it is completely up to you, but if you are buying the dip, don’t do it with the rent money.

Buy the dip with BitPay. Great rates, no hidden fees.

Paying with crypto? Consider stablecoins

Stablecoins provide the efficiency and privacy of cryptocurrency without the volatility. In addition to traditional coins, most BitPay merchants accept the most popular stablecoins like USDC, GUSD, Binance USD and more. See a curated list of places where you can pay with stablecoins in the BitPay Merchant Directory.

Deploy a dollar cost averaging strategy

Dollar cost averaging is a strategy that allows investors to lower their cost basis for an asset by purchasing more of it at regular intervals over time in equal amounts. The idea being that automating your investing in this manner takes some of the emotion out of the decision making. It also gives you opportunities to buy assets at a lower price.

Stop checking your balances so often

We get it, it’s tempting to see just how much your holdings are down this year. But if you’re investing for the long-haul it does more harm than good to check on it obsessively. You know your reasons for acquiring crypto in the first place, if those reasons still hold then nothing has actually changed.

Pay attention to the crypto space, but take it all with a grain of salt

It’s great to follow a handful of trusted crypto news sources you enjoy reading, but overanalysis may only lead to more anxiety. Crypto Twitter in particular can be a murky brew of delusional shilling and unfounded fear, uncertainty and doubt (FUD) from the naysayers, so it’s probably best to take that with two grains of salt.

Brush up on your crypto knowledge

The last bull run happened at an unprecedented rate, introducing millions of newcomers to the world of crypto. This breakneck speed meant that folks may not have had time to truly understand the intricacies of cryptocurrency and blockchain technology. Use this slow period to get back to the basics and learn about things like proof of work vs proof of stake, custodial vs non-custodial wallets, the different types of crypto wallets, stablecoins and other crypto lessons.

Focus on your own financial goals

When you set out on your financial plan of action, you likely had certain ideas and goals in mind. If you already know you’re a diamond-handed HODLer, a market downturn doesn’t fundamentally change your reasons for investing in the first place.

Watch out for high risk projects

There are plenty of established, trustworthy projects in cryptoland that are worth investing in, but there’s also a whole lotta garbage out there. Do your homework before putting hard-earned money into any investment, and if something seems fishy, trust your instincts. Putting large sums of money into niche altcoins or dodgy high-risk projects can be an unwise gamble in these times.

Wrap up for crypto winter

If you’ve been around crypto long enough you’ve seen this boom-bust cycle play out before. But if this is your first crypto winter, your anxiety may be intense. What you’re feeling is definitely normal. Just keep your wits about you, don’t make any rash moves and stay the course of your long-term financial plans. If you’re able to do those things, you may spare yourself some of the angst, and find somewhere warm to hunker down until this crypto winter blows over.

Note: All information herein is for educational purposes only, and shouldn't be interpreted as legal, tax, financial, investment or other advice. BitPay does not guarantee the accuracy, completeness, or usefulness of any information in this publication and we neither endorse, nor are we responsible for, the accuracy or reliability of any information submitted or published by third parties. Nothing contained herein shall constitute a solicitation, recommendation, endorsement or offer to invest, buy, or sell any coins, tokens or other crypto assets. BitPay is not liable for any errors, omissions or inaccuracies. For legal, tax, investment or financial guidance, a professional should be consulted.