October 10, 2024

CEX vs DEX: The Complete Guide to Crypto Exchanges

The Important Bits

entralized exchanges (CEXs) offer high liquidity, user-friendly interfaces, and customer support but come with security and regulatory risks.

Decentralized exchanges (DEXs) prioritize privacy and user control, allowing trades directly from personal wallets without intermediaries.

CEXs are more accessible for beginners, while DEXs require more technical knowledge but offer greater autonomy.

Both CEXs and DEXs have distinct advantages and drawbacks, depending on user needs and preferences.

Hybrid exchanges are emerging, combining the benefits of both CEXs and DEXs.

In the rapidly evolving crypto landscape, choosing between a CEX and a DEX can shape your trading experience. The largest of these are centralized exchanges (CEXs) that maintain traditional order books and require users to go through a know-your-customer (KYC) process. Decentralized exchanges (DEXs), however, operate independently, without a centralized third party managing trades. Crypto users should know the difference between a CEX vs DEX when choosing an exchange.

When considering between a DEX vs CEX have their distinct benefits and drawbacks. One is not necessarily better than the other. However, many users have a personal preference based on what features most appeal to them. It’s important to understand the differences between a centralized vs decentralized exchange so you can choose based on what you’re looking for in a crypto exchange.

What are Centralized Exchanges (CEX)?

Centralized exchanges (CEXs) facilitate the buying, selling, and trading of cryptocurrencies by acting as intermediaries between buyers and sellers. They operate like traditional stock exchanges, holding users' assets in custody and matching trades through an internal order book.

Some well-known centralized exchanges include Coinbase, Binance, and Kraken. These platforms are popular due to their ease of use, extensive asset offerings, and beginner-friendly features.

Advantages of CEXs

High Liquidity: CEXs typically offer high liquidity, allowing for quick and efficient trades at stable prices.

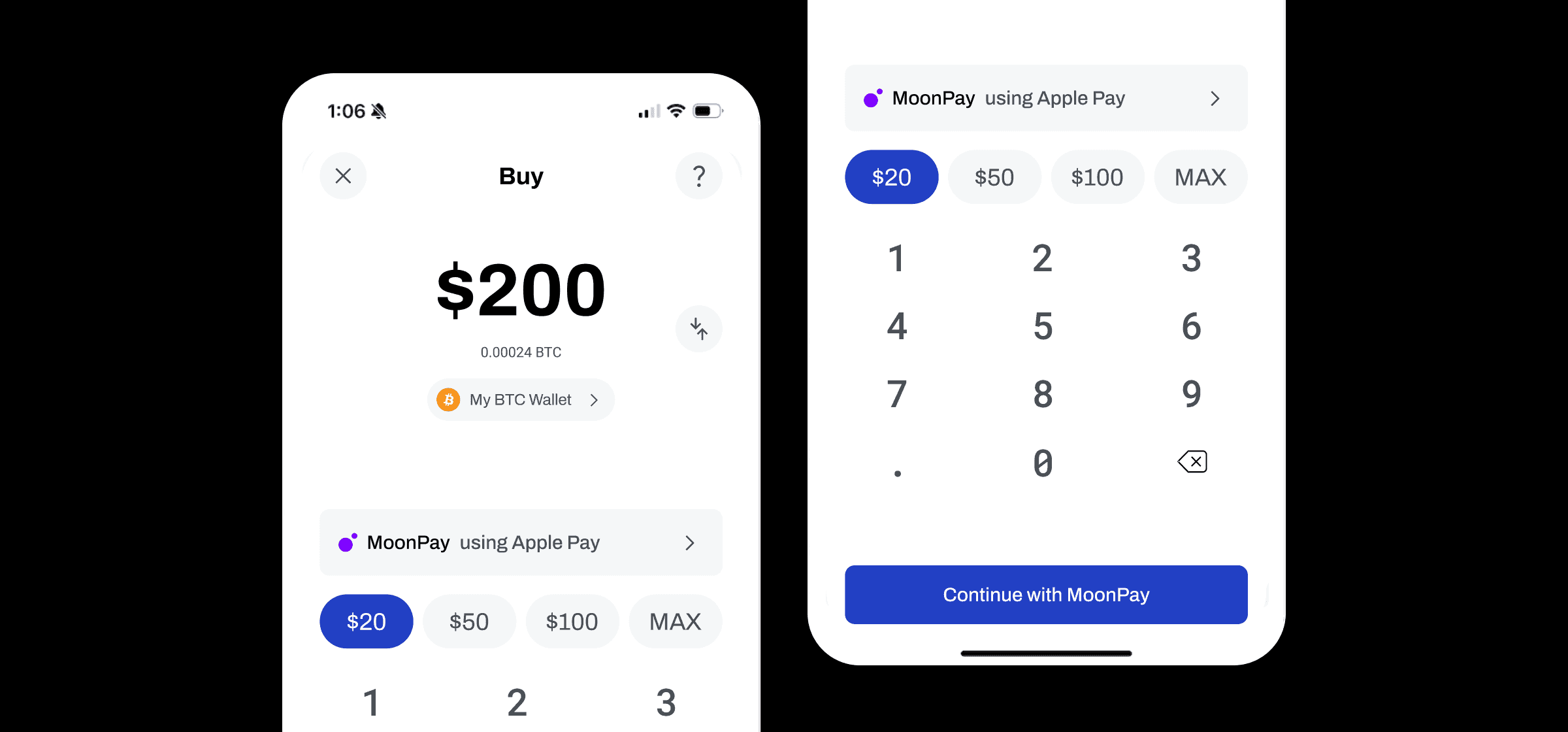

User-Friendly Interfaces: CEXs are designed with beginners in mind. They offer intuitive interfaces that simplify buying, selling, and managing crypto.

Customer Support and Recovery Options: CEXs often provide customer support and account recovery services, offering a safety net for users who might lose access to their accounts.

Disadvantages of CEXs

Security Risks: Since CEXs hold large amounts of user funds, they are prime targets for hackers. Several high-profile hacks have resulted in significant losses. Following best practices for security, like having a strong, unique password, setting up two-factor authentication (2FA), and avoiding phishing emails, can help mitigate these risks.

Regulatory Issues: CEXs are highly regulated, which can lead to limitations on how users trade and identity verification requirements that make users’ crypto activity less private.

What are Decentralized Exchanges (DEX)?

Decentralized exchanges (DEXs) are platforms that allow users to trade cryptocurrencies directly with each other without relying on a third party to facilitate transactions. Instead of using a traditional order book, DEXs operate on a blockchain using smart contracts. The most common model for DEXs is an automated market maker (AMM), although other methods are also used.

Some of the most popular decentralized exchanges include Uniswap, PancakeSwap, and SushiSwap.

Advantages of DEXs

Enhanced Privacy and Anonymity: DEXs don’t require personal information, allowing users to trade anonymously.

User Control Over Funds and Keys: With DEXs, you retain complete control over your assets, as trades are conducted directly from your personal (self-custody) wallet.

Lower Transaction Fees: DEXs often have lower overall fees, especially when network conditions are favorable.

Disadvantages of DEXs

Lower Liquidity: DEXs generally have lower liquidity than centralized exchanges, which can lead to price slippage and slower trade execution.

Complexity and Technical Knowledge Required: Using a DEX often requires understanding how to manage wallets, navigate blockchain transactions, and deal with gas fees, which can be challenging for beginners.

Lack of Customer Support: Since DEXs operate without a central authority, there is no customer support to help recover lost funds or resolve issues, placing the responsibility solely on the user.

Key Differences Between CEX and DEX

Custody of assets

Centralized exchanges (CEXs) hold your assets in their custody. While this can be convenient, it also makes CEXs attractive targets for hackers. Decentralized exchanges (DEXs), on the other hand, allow you to trade directly from your own crypto wallet, giving you full control over your assets and private keys. This adds an extra layer of user responsibility. Personal mistakes can lead to a loss of funds.

Liquidity

CEXs typically offer higher liquidity and trading volume because they aggregate many orders in one place, making it easier to execute trades quickly at stable prices. DEXs often have lower liquidity, resulting in slippage or slower trades, especially for less popular tokens.

Usability and accessibility

CEXs are generally more user-friendly, offering easy-to-navigate platforms, customer support, and various trading tools. While improving, DEXs can still be more complex, requiring users to understand concepts like wallet management and gas fees. However, DEXs can be more accessible since they don’t require personal information to create an account.

KYC and privacy

CEXs are more compliant with regulations, as they require users to complete Know Your Customer (KYC) procedures. This makes CEXs more secure but less private. DEXs, in contrast, prioritize anonymity, allowing you to trade without revealing your identity. This can also be a potential vulnerability, however, as it increases the potential for fraud and makes it harder for anyone who loses funds to get them back.

Trading fees

CEXs often charge trading fees based on the volume of your trades and may offer discounts for higher volumes or for using native tokens. DEXs generally don’t have platform fees, but you must pay gas fees for blockchain transactions, which can be unpredictable and expensive during network congestion.

Use Cases and Scenarios

Users who are new to crypto are likely better off choosing a centralized crypto exchange. These exchanges are made to be as user-friendly as possible. They often have a virtual library of educational materials on all things crypto-related. Customer support is usually easy to access, although this varies depending on the exchange. Reading crypto exchange reviews online can help users get a better idea of the strengths and weaknesses of any given exchange.

DEXs are ideal if you value privacy and control over your funds. They’re perfect for users who want to manage their assets without relying on a central authority or those who wish to trade smaller tokens not listed on CEXs.

Hybrid exchange models are also emerging, combining CEX convenience with DEX control. These platforms aim to offer the best of both worlds, blending ease of use with enhanced security and user autonomy.

Wrap up on CEXs vs DEXs

Centralized and decentralized exchanges (CEX vs DEX) each offer unique advantages and drawbacks, making them suitable for different users. CEXs, like Coinbase and Binance, are user-friendly, with high liquidity and customer support, making them ideal for beginners.

On the other hand, DEXs, such as Uniswap and PancakeSwap, prioritize privacy and user control, allowing trades without intermediaries. While offering lower fees and enhanced anonymity, DEXs come with challenges like lower liquidity, complexity, and a lack of customer support.

Understanding these differences is key to choosing the most suitable exchange for your needs, whether you prioritize convenience or control.

FAQs about crypto exchanges

Which is better: CEX vs DEX?

Neither is inherently better; it depends on your needs and preferences. Centralized exchanges (CEXs) offer more user-friendly interfaces, customer support, and higher liquidity, making them suitable for beginners. Decentralized exchanges (DEXs), on the other hand, provide greater privacy and control over your assets since you trade directly from your wallet.

Is it cheaper to buy on a DEX or CEX?

Costs vary depending on the platform and network fees. Generally, CEXs might have higher trading fees, but DEXs can sometimes be more expensive if transaction fees on the blockchain are high. Sometimes, CEXs offer lower fees for high-volume traders, while DEXs may be cheaper for smaller trades at times when network fees are low.

Is Coinbase a DEX or CEX?

Coinbase is a centralized exchange (CEX). It offers a user-friendly platform oriented toward new cryptocurrency users. Other popular centralized exchanges include Kraken, Gemini, and Binance.

What is a CEX wallet?

A CEX wallet is a crypto wallet provided by a centralized exchange. The exchange controls the private keys, meaning they have custody of your assets. While this makes it easier to manage and trade your crypto, it also opens you up to the risks of a third party controlling your coins. CEX wallets are built into the exchange; any coins held there are in a CEX wallet by default.

Note: All information herein is for educational purposes only, and shouldn't be interpreted as legal, tax, financial, investment or other advice. BitPay does not guarantee the accuracy, completeness, or usefulness of any information in this publication and we neither endorse, nor are we responsible for, the accuracy or reliability of any information submitted or published by third parties. Nothing contained herein shall constitute a solicitation, recommendation, endorsement or offer to invest, buy, or sell any coins, tokens or other crypto assets. BitPay is not liable for any errors, omissions or inaccuracies. For legal, tax, investment or financial guidance, a professional should be consulted.