November 5, 2025

The Best, Safest Ways to Store Your Cryptocurrency: What You Need to Know

The Important Bits

Neglecting to practice secure crypto storage can result in loss of funds.Understanding how to store cryptocurrency requires understanding the different types of wallets, including exchange, hardware, mobile, and paper wallets, as well as the distinction between hot and cold wallets.The best way to store crypto is to use a combination of hardware and mobile wallets, according to an individual’s allocation and use case.

Securing your crypto

One of the most important aspects of crypto is storing funds securely. If you don’t know how to store your crypto safely, it might go missing. In 2024, an estimated $2.2 billion was stolen. And that doesn’t include all of the crypto lost due to user error in years past, or the exchange failures of 2022.

Knowing how to securely store Bitcoin and crypto can greatly decrease the odds that a user falls victim to the most common ways that crypto gets lost or stolen, including:

Hacks

Scams

User error

Exchange failures

In this guide, we’ll go over the basics of how to safely store crypto, the different types of wallets that exist, and address some frequently asked questions.

The best ways to store your crypto: pros and cons of each option

There are multiple ways to store crypto, and each method comes with its own set of considerations related to risk, usability, and security.

Before discussing the different types of crypto wallets, let’s clarify two important categories that wallets fall into: custodial/non-custodial and hot/cold.

Custodial wallets involve a third-party managing the private keys, while self-custody wallets (aka non-custodial wallets) give users full ownership of the keys.

Hot wallets hold funds online where they can be accessed with ease, while cold wallets hold funds offline in cold storage.

All of the following wallets fall into each one of these categories.

Exchange wallets

When you buy crypto on an exchange, the funds automatically go to your exchange wallet. This is a custodial hot wallet hosted by the exchange, who holds the private keys for you.

Pros: Convenient, wide array of assets supported

Cons: Lack of total control over your private keys, risk of hacks and theft, transaction limits may apply

Related: Crypto Wallets vs Crypto Exchanges

Hardware wallets

Hardware wallets allow users to hold their private keys in cold storage, where they are inaccessible to hackers. These wallets can be brought online to make transactions. The signing of a transaction occurs on the physical hardware device itself, which is separate from a user’s personal computer, making things even more secure.

Pros: High degree of security

Cons: Could be confusing for less technical users, and costs ~ $100 on average, less convenient for making transactions

Mobile wallets

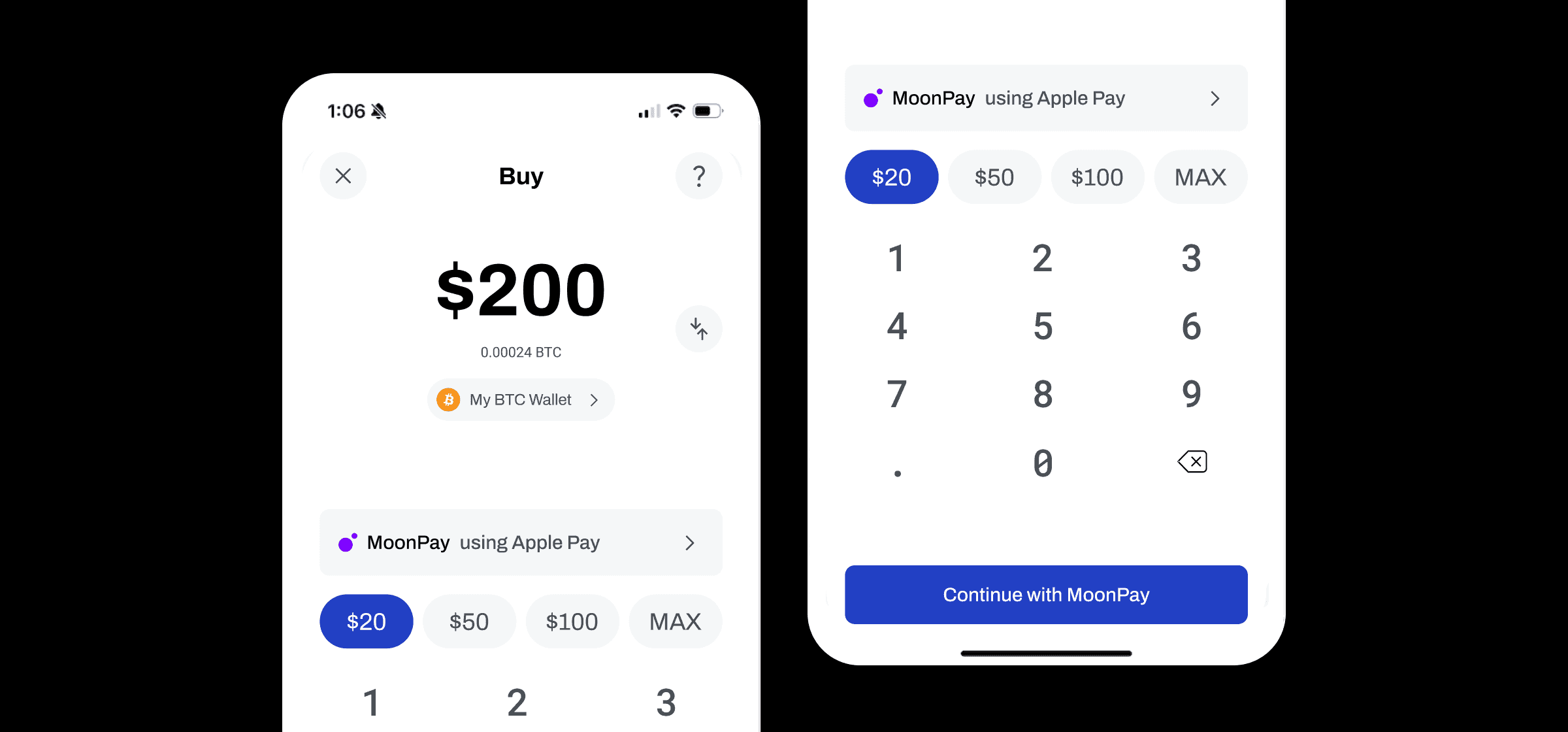

A mobile wallet is a hot wallet held on your smartphone. These are usually self-custodial. Mobile wallets can be great for sending or paying with crypto. However, they can be less secure than cold wallets, and are not advised for storing large balances.

Pros: Quick and easy to use, good for transactions, high degree of flexibility

Cons: Potential for loss funds if not secured, backed up properly or seed phrase is compromised

Paper wallets

Prior to the invention of hardware wallets, paper wallets were the only cold storage option available in the early days of crypto. A paper wallet can be created by printing out a private and public key. Once funds are sent to the public key, they are taken offline, and can only be accessed by sweeping the private key into a hot wallet. The potential for user error here is substantial, and paper wallets are not often used anymore.

Pros: Provides an affordable cold storage option

Cons: High risk of user error or wallet damage

Bonus: Multisignature wallet

Multisignature wallets (also known as "multisig") enhance security by requiring multiple signatures to approve transactions. This feature is ideal for businesses or individuals managing large crypto holdings. It reduces the risk of single-point failures and unauthorized access. Multisig wallets can come in the form of hot or cold self-custody wallets. They can be used across to spread wallet authorization across multiple people or by a single party leveraging multiple devices.

Pros: Can be used on a hot or cold wallet, no single point of failure

Cons: Could be confusing for less technical users

Our recommendations for securely holding cryptocurrency

The best way to store crypto will vary from individual to individual. When making related decisions, there are some important questions to ask, such as:

How much have I invested in crypto? The greater the amount, the more a set of stringent security measures could be warranted.

How often will I want to spend/send my crypto? The more often someone makes crypto transactions, the more they may be willing to sacrifice some security in exchange for easier access to a portion of their funds.

What is my level of technical expertise? Because security must be balanced with usability, less technical users may also choose to opt for less secure options. The overall risk of doing so could be less than the risk of user error that comes with more technologically secure options.

It is widely accepted that the safest way to store crypto is a self-custody cold wallet. As covered earlier, options include hardware wallets and paper wallets. But that’s not to say that holding 100% of funds in cold storage is right for everyone.

Those who hold only small amounts of crypto might be okay with an exchange wallet that makes it easy to send transactions, even though it’s less secure. It’s worth noting that a non-custodial wallet of any kind can be just as easy to use while also being more secure, as the keys are entrusted to the user rather than a third-party.

Holding large sums of crypto creates a different picture. To prioritize security, storing the majority of funds in cold storage on a hardware wallet would be the best option. A small balance could still be held in a hot wallet for making transactions quickly and easily.

Managing multiple wallets for different purposes is a popular choice for seasoned crypto users and whale. For example, some users might use a combination of wallets, such as:

A hardware wallet for long-term cold storage

A mobile self-custody wallet like the BitPay Wallet for spending and transacting with crypto

An exchange wallet for trading niche crypto coins and tokens

The safest way to store crypto: it depends

In the end, the best way to store crypto depends on the user and their needs. A blend of hot and cold wallets can create a good balance between security and usability. Remember to create backups for your wallets and educate yourself on the mechanics of your wallet of choice so as to minimize the chance of user error.

FAQs about crypto storage

What is the difference between hot and cold wallets?

A hot wallet holds funds on a device that is constantly connected to the internet. Cold wallets hold coins in offline cold storage, where they are safe from hackers. A cold wallet can be brought online temporarily to make transactions.

What’s the difference between a self-custody and custodial wallet?

A self-custody wallet means that users control their private keys and have full ownership of their coins. A custodial wallet refers to a wallet where a trusted custodian holds the private keys to user funds. Read more about the benefits of self-custodying your crypto.

Why is it essential to back up a Bitcoin wallet?

It’s essential to back up a Bitcoin wallet because there could be a number of scenarios where users lose access to their wallet. Examples include losing a physical hardware wallet or forgetting the passcode to either a hardware or software wallet. With a backup such as a seed phrase, users can create a new wallet and restore their balances in the event that something goes wrong. Learn more about the best ways to store your crypto seed phrase.

What is multi-signature in cryptocurrency storage, and how does it enhance security?

A multisignature wallet is one that requires multiple keys to sign a transaction. A 2 out of 3 multi-signature, for example, would require signatures from 2 keys before a transaction could be sent. This can increase security by allowing users to place wallet keys in different geographical regions, making it much more difficult for an attacker to access the funds.

Share this post

Note: All information herein is for educational purposes only, and shouldn't be interpreted as legal, tax, financial, investment or other advice. BitPay does not guarantee the accuracy, completeness, or usefulness of any information in this publication and we neither endorse, nor are we responsible for, the accuracy or reliability of any information submitted or published by third parties. Nothing contained herein shall constitute a solicitation, recommendation, endorsement or offer to invest, buy, or sell any coins, tokens or other crypto assets. BitPay is not liable for any errors, omissions or inaccuracies. For legal, tax, investment or financial guidance, a professional should be consulted.