You bought low, hodl’d and now are ready to enjoy some of your crypto gains. In addition to paying with crypto directly, cashing out Bitcoin or other cryptocurrencies is something every crypto holder should know about. Here are the top ways to convert Bitcoin to cash fast, cheaply, easy and securely.

How to turn your Bitcoin into cash

There are typically four ways to turn Bitcoin into cash instantly:

- Sell Bitcoin in the BitPay Wallet app

- Sell crypto for cash on a central exchange like Coinbase or Kraken

- Use a P2P exchange

- Use a crypto debit card like the BitPay Card

- Seek out a Bitcoin ATM

- Bonus: Gift cards

Each cash out method may not be right for every situation. Read on to see which method is the best for you.

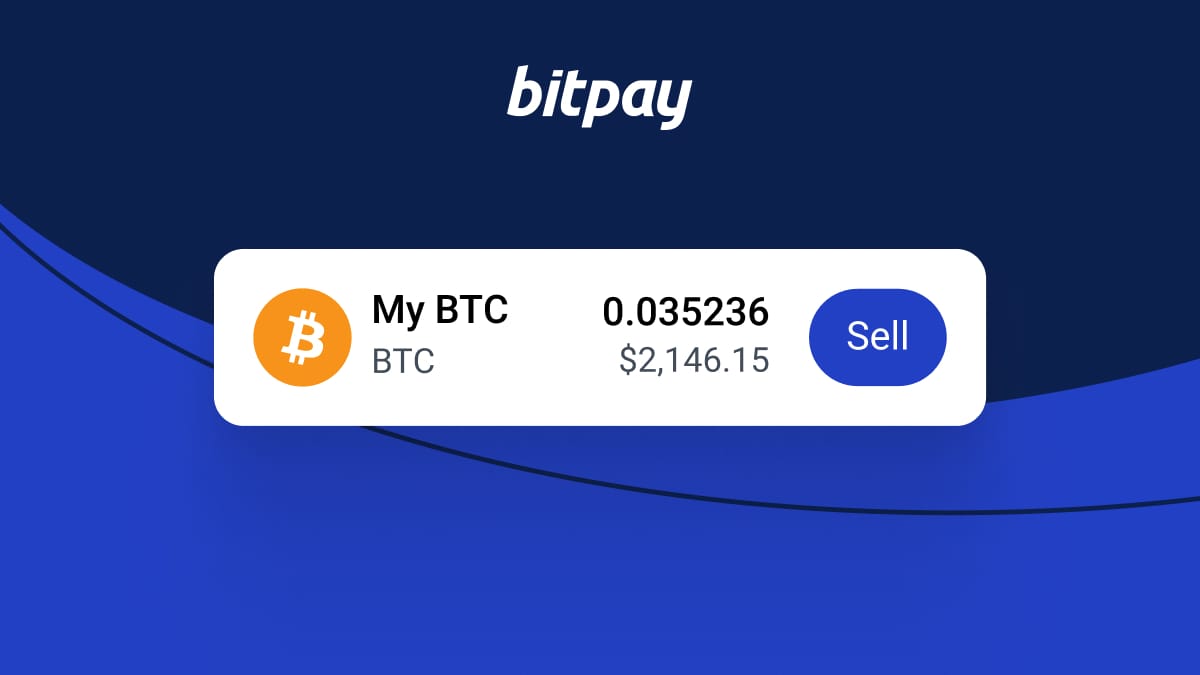

Sell Bitcoin in the BitPay Wallet app

Pros

- Quick delivery

- Sell from self-custody wallet

- Cash out to bank account

- Cash out to existing credit/debit card

- Flexible limits; cash out as little as $30 and up to $100k daily

Cons

- Only available in the BitPay app

When selling Bitcoin, BitPay facilitates the process through its app, providing a user-friendly platform for either profit-taking or liquidity needs. Users can enjoy transparent transaction fees and flexible selling limits, ensuring they can sell amounts that suit their financial strategies. The app offers various payout options, enabling efficient transfers to bank accounts or linked cards, all while maintaining high security and competitive rates for Bitcoin transactions. Read more about how to sell crypto with BitPay.

The best self-custody app for selling, buying, storing, and spending BTC

Sell crypto on and exchange for cash

Pros

- Easy to sell if you already have a custodial wallet

- Lots of exchanges to choose from

- Faster than P2P sales

Cons

- Additional service fees on all transactions

- Requires a bank account

You can use a crypto exchange like Coinbase, Binance, Gemini or Kraken to turn Bitcoin into cash. This may be an easy method if you already use a centralized exchange and your crypto lives in a custodial wallet. Choose the coin and amount you’d like to sell, agree to the rates and your cash will be available to you. However, one common complaint about exchanges includes the fees associated with transactions. Since the exchange is providing a service, you will pay the crypto transaction fee, as well as a service fee that the exchange collects to cover its business costs. You will also need a bank account to deposit your cash into.

Peer-to-Peer (P2P) exchanges

Pros

- Typically lower fees than converting to cash on centralized exchange

- Can negotiate to get the most money for your crypto

Cons

- Can take longer than selling on centralized exchange

- Requires a bank account

Whereas exchanges like Kraken, Coinbase and Gemini are centralized exchanges where one entity controls the crypto, a peer-to-peer exchange is one where the transaction occurs between two individuals. The buyer and the seller are interacting directly without an intermediary (like a bank or company). P2P transactions can be a lucrative way to cash your cryptocurrency out since you set your price and there are less fees. However, the process is much more involved than loading a debit card or selling on a centralized exchange. If you don’t need cash right away and want to sell on your own terms then this may be a good way for you to convert crypto into cash.

Get cash from a Bitcoin ATM

Pros

- ATMs available across the world

- No bank account necessary

Cons

- High fees compared to traditional exchanges

- Rural areas may not have an abundance of machines

- Cash out limited to the amount of cash in a machine

Bitcoin ATMs are specialized banking machines from which you can buy and sell crypto. To buy crypto, you insert cash. To turn your crypto into cash, the machine will create an invoice from which you sell your crypto at an agreed upon rate. These machines are available across the world. They provide a quick and easy way to receive cash for cryptocurrency without a bank account. However, fees can be quite expensive compared to other methods and if you are in a rural area, you may have trouble finding a machine to use. Find an ATM close to you here.

Use a crypto debit card to turn Bitcoin into cash

Pros

- Quick and easy process

- Get cash from ATMs or use in-store and online

- No bank account required

- Cash out a lot or a little depending on your situation

Cons

- Only applicable for U.S. residents

- Standard ATM fees apply

Crypto debit cards operate similarly to a regular debit card. However, instead of using a bank account, the card pulls funds from a crypto wallet. The BitPay Card is one of the top crypto cards for U.S. residents. It gives you the flexibility to cash out Bitcoin to USD. Use it to cash out Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Litecoin (LTC), Dogecoin (DOGE), Shiba Inu Coin (SHIB), ApeCoin (APE), Polygon (MATIC), Wrapped Bitcoin (wBTC), Dai (DAI), USD Coin (USDC), Gemini Dollar (GUSD), Binance USD (BUSD) and Pax Dollar (USDP). It is also one of the cheapest ways to convert crypto to cash, while still receiving your cash near instantly. Load the card from your BitPay Wallet balance or connect to a Coinbase account. You can use the card to pay for things in-store, shop online or even pull cash straight from an ATM. Apply and get approved in minutes. Then start spending crypto like cash instantly.

Bonus: Buy gift cards with crypto

While technically not cash, converting crypto into gift cards usable practically anywhere is a close compromise. BitPay allows you to purchase gift cards with Bitcoin along with 15+ other top cryptocurrencies. Cash out crypto onto popular gift cards like prepaid Mastercards, Best Buy gift cards and more.

What to consider when cashing out

Turning Bitcoin into cash may seem simple, but there are a few things you’ll want to consider before cashing out your crypto wallet.

Taxes

Converting crypto into fiat is a taxable event whether you are selling on an exchange, P2P, using a Bitcoin ATM or loading onto a crypto debit card. You will want to talk to a tax professional to understand how crypto transactions are taxed in your area.

Transaction fees

You will pay fees to convert your cryptocurrency into cash. Depending on how large or small your transaction is may determine which method you use.

Speed

Each method takes its own amount of effort and time. For example, using the BitPay Card or selling on a centralized exchange takes far less time and effort than selling on a P2P exchange or seeking out a Bitcoin ATM.

Market health and long term goals

Some crypto enthusiasts are in it for the long haul while others may choose to cash out as soon as they make a profit. Figure out which camp you live in and decide whether converting your crypto into cash is the right finance decision for you at this moment.