February 28, 2023

BitPay Partners with ZenLedger for Easy Crypto Tax Management and Filing - Get 20% Off Subscription

BitPay and ZenLedger have partnered to bring simple crypto tax filing to all BitPay users. ZenLedger is the IRS’ sole source provider of forensic accounting and taxation software for cryptocurrencies, offering advanced features to get your crypto taxes done in minutes. With an easy three step process, crypto investors globally can import transactions directly from your BitPay Wallet to ZenLedger’s crypto tax software, ensure reports are accurate and generate all the forms you need to accurately file your taxes. BitPay Wallet users will receive a 20% discount on ZenLedger’s tax software plans.

Benefits of using BitPay + ZenLedger for crypto taxes

Import transactions straight from the BitPay Wallet

Calculate cost basis, fair market value and gains/losses for your transaction history

Tax loss-harvesting tool for all customers

Chat and phone support provided by ZenLedger

Automatically generate your crypto tax documents

How to use BitPay + ZenLedger to prepare your crypto taxes

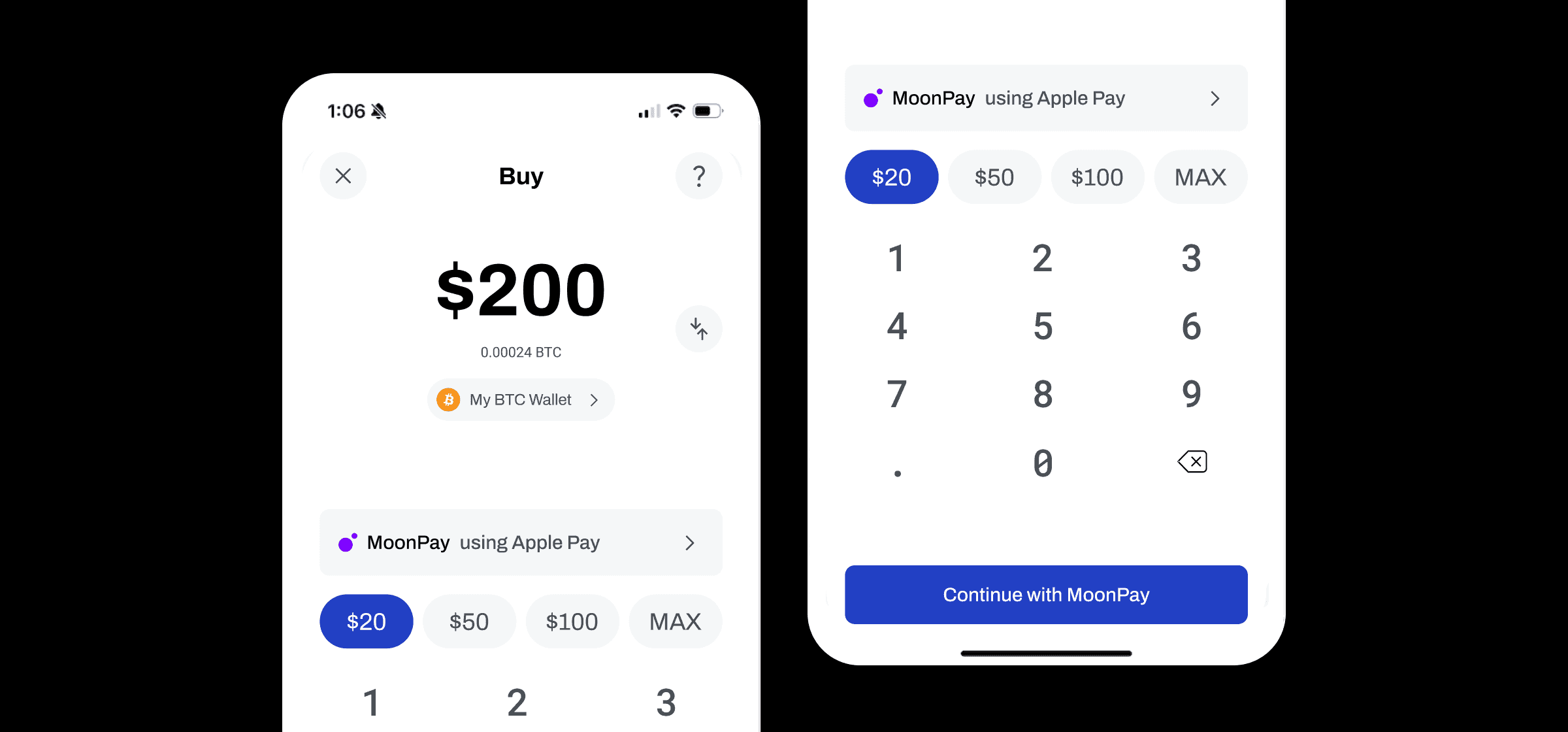

Make sure you have the latest version of the BitPay Wallet or download the app here

Tap into the app Settings section

Select ZenLedger Taxes

You will be prompted to connect your wallet to ZenLedger

Log in or create a ZenLedger account – don’t forget to use the discount code in the app for 20% off

Choose the wallets holding the transactions you wish to import into ZenLedger

Once you’ve created a ZenLedger account and connected your wallet, your transactions will appear within your ZenLedger dashboard. Now you are ready to use ZenLedger to prepare and file your crypto taxes. Learn more about crypto taxes with BitPay's tax guide.

Take control of your crypto

Get the BitPay Self-Custody Wallet

Tax-loss Harvesting

The last few quarters have been up and down for many in cryptocurrency. Did you buy crypto at the wrong time and now you’re looking at a loss? Make it work for you when tax time comes. Tax-loss harvesting is the process of selling a cryptocurrency that has experienced a loss to realize that loss. By “harvesting” the loss, investors can offset taxes on both gains and income. The sold cryptocurrency can then be replaced in the portfolio in order to maintain an optimal asset allocation and expected returns.

All BitPay Wallet users that sign up with ZenLedger will have access to ZenLedger’s tax-loss harvesting tool. Read ZenLedger’s guide to tax-loss harvesting to learn more and get started.

Note: All information herein is for educational purposes only, and shouldn't be interpreted as legal, tax, financial, investment or other advice. BitPay does not guarantee the accuracy, completeness, or usefulness of any information in this publication and we neither endorse, nor are we responsible for, the accuracy or reliability of any information submitted or published by third parties. Nothing contained herein shall constitute a solicitation, recommendation, endorsement or offer to invest, buy, or sell any coins, tokens or other crypto assets. BitPay is not liable for any errors, omissions or inaccuracies. For legal, tax, investment or financial guidance, a professional should be consulted.