January 15, 2021

Your January Newsletter for All Things BitPay and Crypto

In this edition of the January Cryptie, we have decided to look back at 2020 in review for BitPay. Despite a rollercoaster of a year for the world, one thing has remained certain: cryptocurrency remains at the forefront of the future of finance. On January 1, 2020, Bitcoin (BTC) opened at $7,194.89 USD. Three hundred sixty-five days later, that value nearly quadrupled to $29,001.72 USD at the end of December 31, 2020. We believe that 2021 will be the year that crypto becomes widely adopted not just for speculation but also for payments and other utilities. We expect that improved regulations and enterprises like Square and PayPal will drive crypto to become an accepted form of payments globally.

Graph Courtesy of Coindesk - https://www.coindesk.com/price/bitcoin

In This Issue:

BitPay’s Key Accomplishments in 2020

BitPay filed paperwork with the U.S. Office of the Comptroller of the Currency (OCC) to create a national bank named the BitPay National Trust Bank.

In November 2020, BitPay was ranked 341 on Deloitte’s Technology Fast 500™, a ranking of the fastest-growing technology, media, telecommunications, life sciences, and energy tech companies in North America. That same month, BitPay was selected as a finalist for Red Herring’s Top 100 North America award, one of the technology industry’s most prestigious prizes.

BitPay placed among the Inc. 5000 list for 2020, demonstrating strong annual growth for three years straight. Learn more here.

Frost & Sullivan, a leading market research and consulting firm, recognized BitPay as the Company of the Year in the alternative payments space.

BitPay was honored with the Best Alternative Payment Solution award. from CNP Summit. Each year, the CNP Awards is the only awards competition honoring the companies, programs and solutions that have distinguished themselves in the card not present space throughout the year.

New Product(s) and Services from BitPay

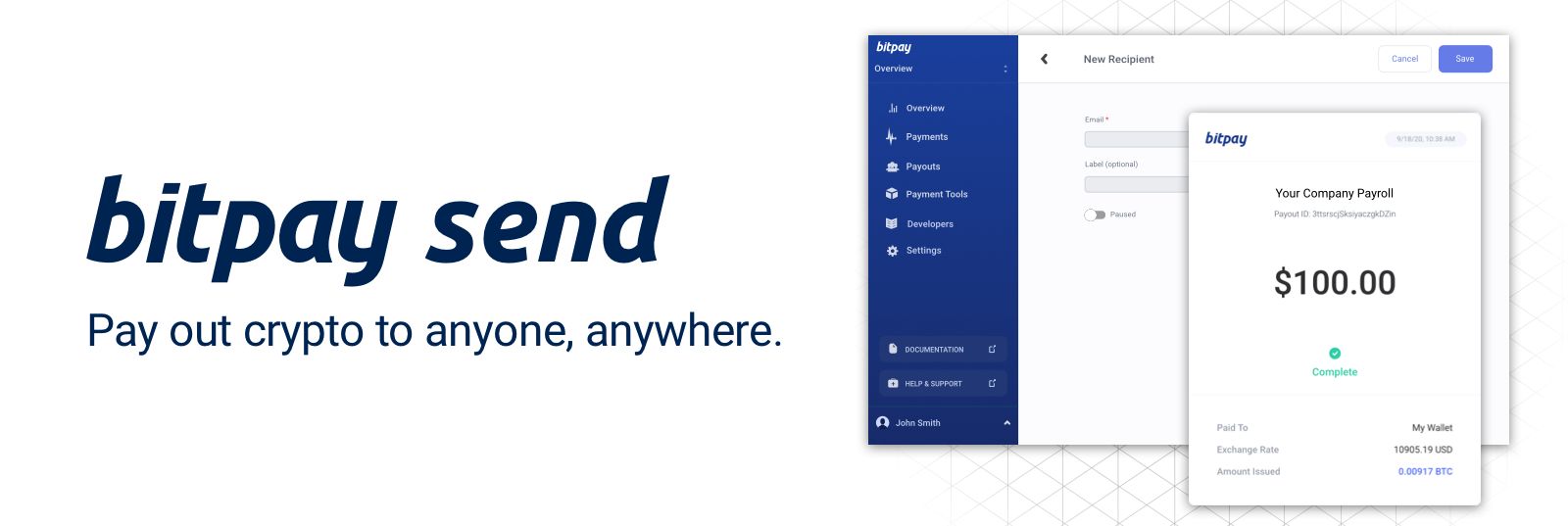

Earlier in the year, BitPay expanded options to allow all BitPay invoices to be paid from any Bitcoin wallet or exchange. Then came BitPay Send - our new mass payout service that enables organizations to pay employees, affiliates, customers, vendors, contractors, and more with cryptocurrency. Learn more about BitPay Send on our website or contact our sales department directly.

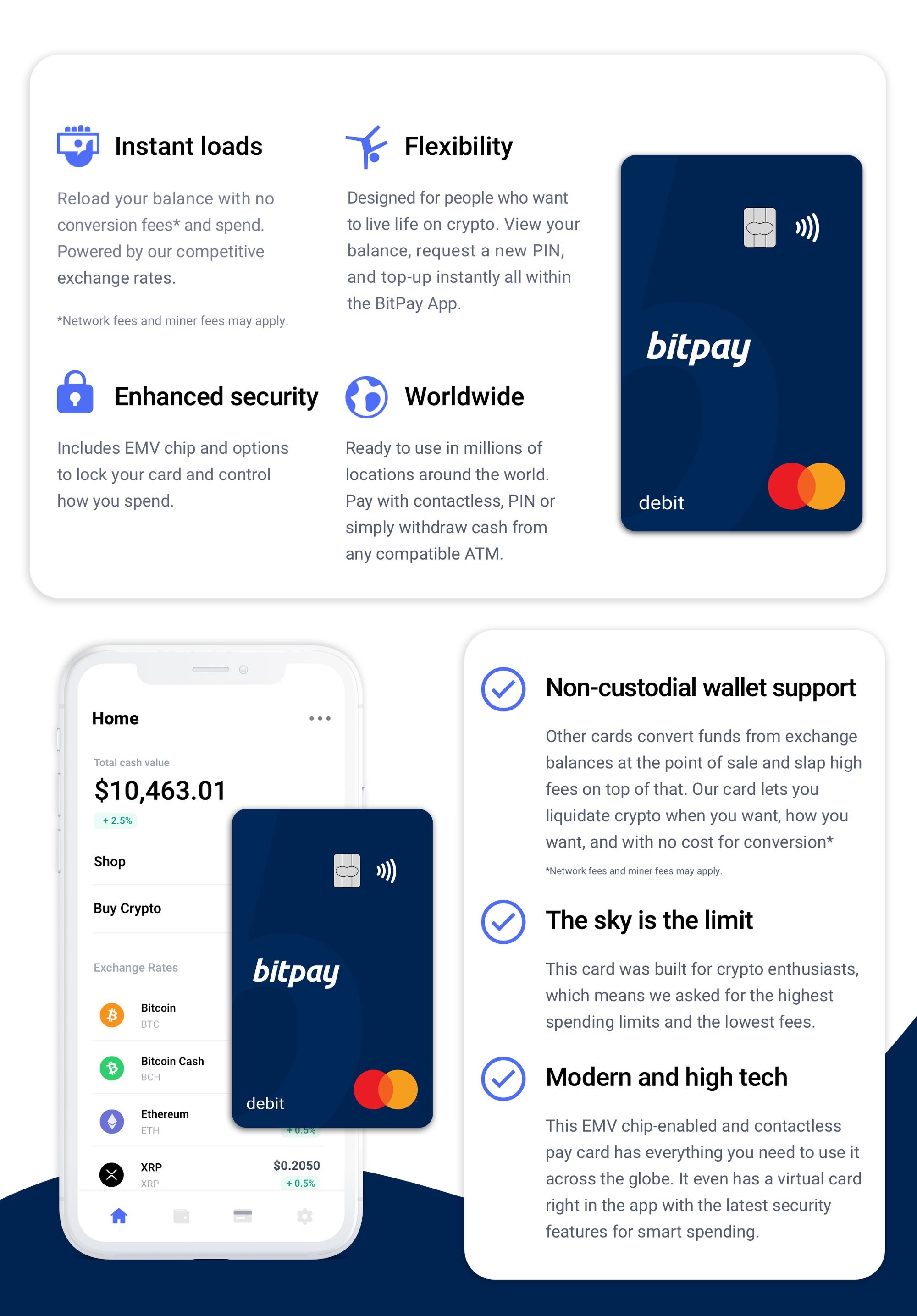

BitPay launched our first-ever US prepaid Mastercard that can be loaded with dollars that are converted from cryptocurrency. With instant card reloads, no conversion fees*, a $10,000 daily load and spending limit, and the ability to spend at millions of locations worldwide, the new BitPay Card will enable you to live your life on crypto.

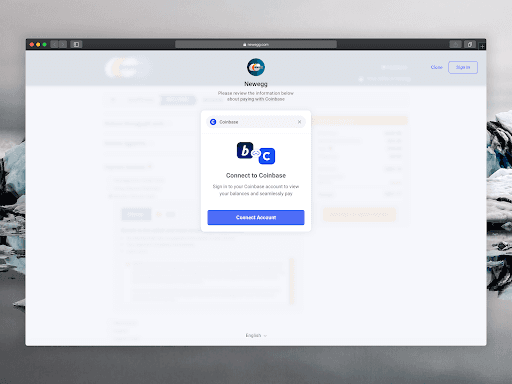

BitPay expanded its partnership with Coinbase in 2020. Coinbase customers can now spend their bitcoin, USD coin, ethereum, and other blockchain-based payment systems at BitPay-enabled merchants — without having to pay fees or experience any latency. To find out more, you can read about it here.

How BitPay Has Been Leading the Industry

Stephen Pair, Co-Founder, and CEO of BitPay gave a recent interview to the popular “Leaders in Payments” industry podcast. You can listen to the podcast here.

Bill Zielke, Chief Marketing Officer of BitPay, made a guest appearance on PayPod: The Payments and Fintech Podcast, talking about the mechanisms that enable merchants to accept crypto as payment. Listen here.

Eden Doniger, BitPay’s General Counsel & Chief Compliance Officer, was on an International Panel of FinTech, Trade, and Global Payment professionals discussing the latest industry trends and developments. Watch the replay here.

A commissioned study for BitPay from Forrester Research confirmed in writing what merchants are already discovering in real-life practice: that businesses adopting bitcoin and other cryptocurrencies as payment methods experience, on average, 40% more customers, a twofold increase in order values, and fewer chargebacks, among many other benefits

2020 BitPay Numbers at a Glance

BitPay’s wallet now has over 3 million users globally and in December 2020 had almost 100k new users in Nigeria alone.

Nearly 33k global merchants registered with BitPay in 2020, with top countries being the United States, Nigeria, United Kingdom, Canada and Germany. Top industries included Apparel/Fashion, Computer Software/Engineering, Retail, Marketing/Advertising/Sales, and VPN Hosting.

40% of BitPay merchants’ sales were net new customers, and these customers also had order sizes on average twice that of a credit card.

Latest Industry News

BTC now has a market cap of $525 million which makes it the 5th largest currency in the world (behind USD, EUR, CNY, and JPY). Ethereum now has a market cap of $80 billion so BitPay merchants now have access to over $600 billion of market cap spend globally. BitPay also supports Bitcoin Cash and 4 stable coins. Here are some other interesting developments in the space:

The SEC and Ripple are in a lawsuit about XRP being ruled as a security. While this is going on, BitPay has decided to suspend XRP payments for BitPay merchants

PayPal Holdings, Inc. announced the launch of a new service enabling its customers to buy, hold and sell cryptocurrency directly from their PayPal account. That means over 300 million PayPal and Venmo wallets now have easy-access to crypto.

Coinbase plans to go IPO in Q1 - We believe this IPO will be a huge success and drive more media attention to crypto and get more stock trading firms to allow crypto trading.

Square has purchased $50 million in Bitcoin, which represented 1% of their total assets at the end of the second quarter in 2020. Microstrategy Inc. followed suit in purchasing a similar amount later in the year, bringing their total BTC treasury value to over $2 billion.

Interested in accepting bitcoin payments? Click here to get in touch with a BitPay representative today.

BY USING THIS CARD YOU AGREE WITH THE TERMS AND CONDITIONS OF THE CARDHOLDER AGREEMENT AND FEE SCHEDULE, IF ANY. This card is issued by Metropolitan Commercial Bank (Member FDIC) pursuant to a license from Mastercard International. “Metropolitan Commercial Bank” and “Metropolitan” are registered trademarks of Metropolitan Commercial Bank ©2014.

Mastercard is a registered trademark and the circles design is a trademark of Mastercard International Incorporated

Note: All information herein is for educational purposes only, and shouldn't be interpreted as legal, tax, financial, investment or other advice. BitPay does not guarantee the accuracy, completeness, or usefulness of any information in this publication and we neither endorse, nor are we responsible for, the accuracy or reliability of any information submitted or published by third parties. Nothing contained herein shall constitute a solicitation, recommendation, endorsement or offer to invest, buy, or sell any coins, tokens or other crypto assets. BitPay is not liable for any errors, omissions or inaccuracies. For legal, tax, investment or financial guidance, a professional should be consulted.